“Corn has a steady and growing demand, as it is the cheapest component of animal feed…”

Vlamir Brandalizze is the founder of Brandalizze Consulting, an agribusiness market consultant, and speaker. Brandalizze holds a degree in Agronomy from the Federal University of Paraná.

Vlamir Brandalizze, founder of Brandalizze Consulting

AgriBrasilis – Will a global corn shortage be imminent soon? What are the implications for Brazil?

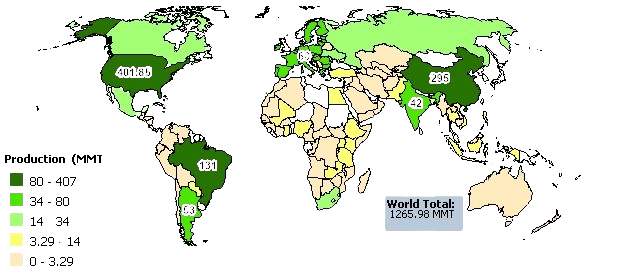

Brandalizze – There won’t be a shortage. What’s expected this season—and likely in the next ones—is global production lower than consumption. We’ll produce less than we consume and will rely on existing stocks. That’s already happening in 2025: world production is slightly above 1.220 billion tonnes, while consumption is projected to exceed 1.250 billion tonnes. In 2026, stocks will be used again, as production is expected to remain below global demand.

AgriBrasilis – What factors are increasing demand for corn?

Brandalizze – Corn has constant and growing demand because it’s the cheapest component in feed. There’s also increasing demand from the energy sector, particularly for ethanol. Global consumption is surging as feed usage breaks records year after year, driven by global population growth. Demand for eggs, milk, poultry, pork, beef, and fish is rising—and all depend on feed.

Regarding corn ethanol, Brazil consumed 17 million tonnes of corn for ethanol production in 2024. In 2025, that could exceed 20 million tonnes. The U.S. uses over 140 million tonnes for ethanol, and this number is rising in many countries. Paraguay, for instance, uses around 6 million tonnes. So corn ethanol consumption is expanding globally.

Corn is expected to continue playing a major role in ethanol production. Several ethanol factories are under construction or expansion. There are even new plants being built for ethanol from sorghum, such as in Luiz Eduardo Magalhães.

AgriBrasilis – Will low temperatures affect crop yields?

Brandalizze – In this second-crop corn, the cold is expected to have little impact because most fields are no longer at risk. If frost comes 15 days from now or later, it won’t affect production, as harvest will be underway. It may even help farmers by controlling weeds, reducing impurities during harvest.

So, from now on, I believe there will be no major weather issues. Weather conditions in 2025 have generally favored crop development.

“A softer dollar, as seen in recent weeks, limits corn export prices, which slows down international trade…”

AgriBrasilis – How is the exchange rate affecting the market?

Brandalizze – A softer dollar, as seen in recent weeks, limits corn export prices, which slows down international trade. Still, this should have little impact on export volumes. However, it may reduce farmers’ revenues if the dollar stays below R$5.60.

AgriBrasilis – How are input prices affecting farmers’ profitability?

Brandalizze – Inputs are priced in dollars, so the current exchange rate may benefit farmers. For corn, the cost-benefit ratio is favorable, which has stimulated negotiations for the 2026 second-crop corn. Many deals are being made through barter—corn in exchange for inputs.

AgriBrasilis – How are U.S. tariffs impacting the corn market?

Brandalizze – These tariffs are opening up opportunities for us in markets currently served by the U.S. We might see new markets or expand in existing ones if the tariffs persist.

I believe this situation will eventually be resolved, and the U.S. will remain a major exporter. Brazil, meanwhile, is likely to keep its position as the world’s second-largest corn exporter.

READ MORE: