“…low unemployment rate and exports at a record level, brought greater stability and less risk to operations related to the live cattle market…”

Pedro Gonçalves is a market analyst at Scot Consultoria, graduated in agronomic engineering from Universidade Estadual Paulista “Júlio de Mesquita Filho” – Unesp.

Scot Consultoria carries out market research, analysis and projections, evaluation and expertise, focusing on cattle farming in Brazil.

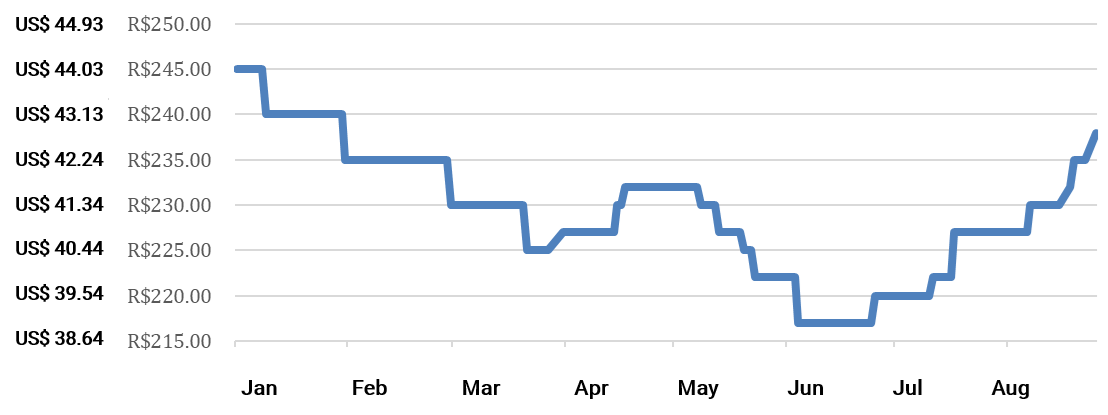

The changes in prices paid for beef cattle began 2024 with constant declines. With the reference for gross and forward prices in São Paulo, there was a drop of around US$ 3.60/@ between January and April [@, or “arroba” is equal to 15 kg] . The recovery in the middle of the year is due to greater demand, mainly internal, but the increased supply in the winter period ended up bringing lower prices (mid-June to July).

Since then, we have been witnessing a recovery in prices, moving from the lowest reference, US$ 39.11/@, to a level similar to that at the beginning of the year, US$ 42.89/@.

Pricing of live cattle in US$/@ in São Paulo (gross and forward prices)

Source: Scot Consultoria; translated by AgriBrasilis

Source: Scot Consultoria; translated by AgriBrasilis

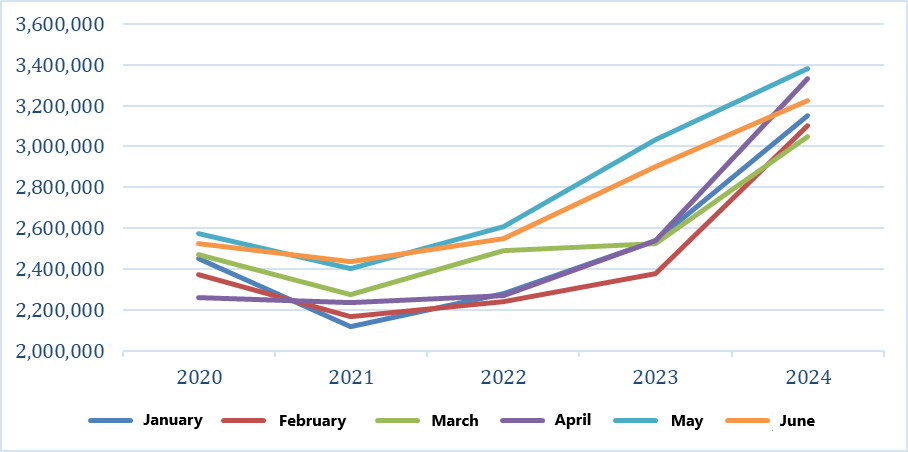

This downward trend in prices paid was directly influenced by the high volume of slaughter in the first half of the year. After two years of severe retention of cows [farmers were not slaughtering females], 2020 and 2021, taking advantage of extremely positive prices for calf arroba (@), the following years began to receive a greater volume of slaughtered females, and consequently a greater volume of cattle offered.

Cattle slaughter in the first six months of the year, in millions of heads, in Brazil (last 5 years)

Source: IBGE; translated by AgriBrasilis

Source: IBGE; translated by AgriBrasilis

However, the scenario at the beginning of the year could have been one of more severe losses. Domestic consumption is showing a positive sign, given the recovery in the household consumption index (ICF). This factor, in addition to the low unemployment rate and exports at a record level, brought greater stability and less risk to operations related to the live cattle market.

“The time to think about the strategy for next year, looking at the market possibilities, is now”

Another positive point was the good margins of the industries currently, which, even with a lower volume of offers, still accelerate purchases to ensure this positive moment, given a strengthened dollar against the real.

What about the pastures in the current scenario?

To find out this, Scot Consultoria carried out a field study: 246 farmers were interviewed, in 16 States, with a declared area of 234.9 thousand hectares.

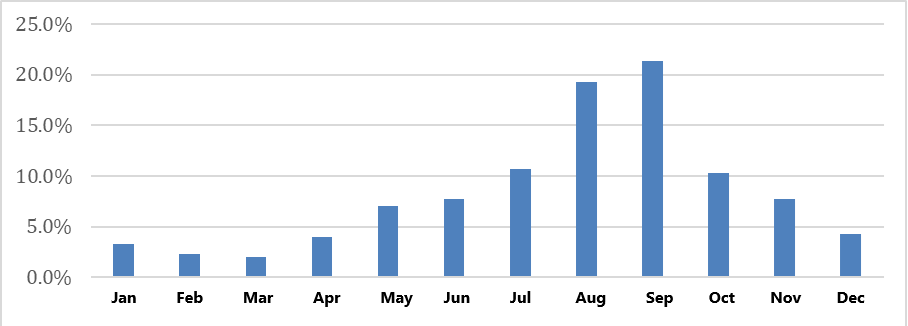

The time to think about the strategy for next year, looking at the market possibilities, is now. In this study, we noted that the acquisition of seeds is distributed throughout the year, for logistics and delivery reasons, but August and September account for 40.6% of purchases from the farmers that we interviewed.

Distribution (%) of months of purchase of pasture seeds in the year

Source: Scot Consultoria; translated by AgriBrasilis

This moment of purchase reflects, considering a planning and delivery vacuum, the responses for the period of implementation of pasture reform, which would be for the months with most rain (summer in Brazil), between October and December.

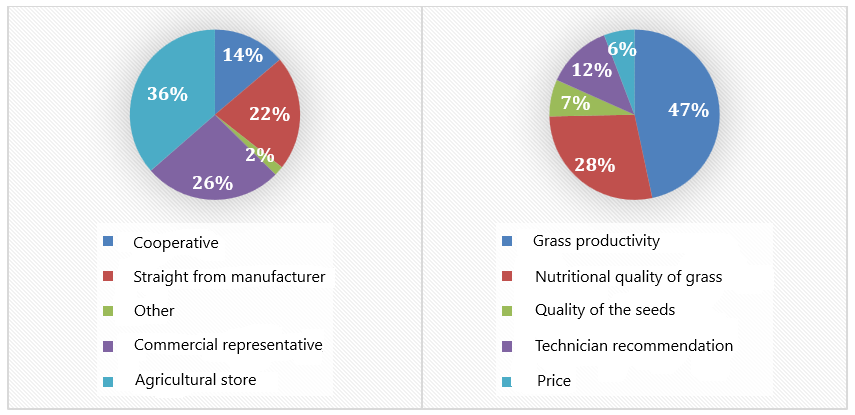

The production bottleneck in this case would be in the form of acquiring materials, from the technical perspective of implementing the crop until its development. Agricultural stores account for most of the places where pasture seeds are purchased, along with the commercial representative. These are two of the channels that, theoretically, would not be concerned with the technological package being used, but with the sales volume.

Distribution (%) of seed purchase channels and participation of cultivar choice factors (%)

Source: Scot Consultoria; translated by AgriBrasilis

Within the research universe, the weight of grass seed pricing was greater for farmers in the State of São Paulo, with 31.6% of them opting to choose based on price, followed by the State of Minas Gerais (26.3%).

If we look at this data, the current moment is the first prominent window for investments, already with an end of the year with more positive pricing. This is because a second half of the year driven by a reduction in cattle offers in the first quarter, and a stronger demand for the second quarter, brings a scenario of more positive prices paid for the live cattle market.

And, with this, investments in the activity towards the end of the year should increase, with the possibility of 2025 being a very positive scenario, with the turnaround in the livestock cycle more evident. And this also applies to breeding and rearing, systems practically carried out on pastures, and which are already showing signs of recovery in price levels, see the exchange relationship with fat cattle, where more arrobas of fat cattle are needed to be sold to purchase a calf.

READ MORE: