Pesticide registration outlook

Flavio Hirata holds a degree in Agronomy from the University of Sao Paulo (ESALQ), is partner of AllierBrasil, expert in pesticide registration and has been promoting Brazilian agribusiness since 1999.

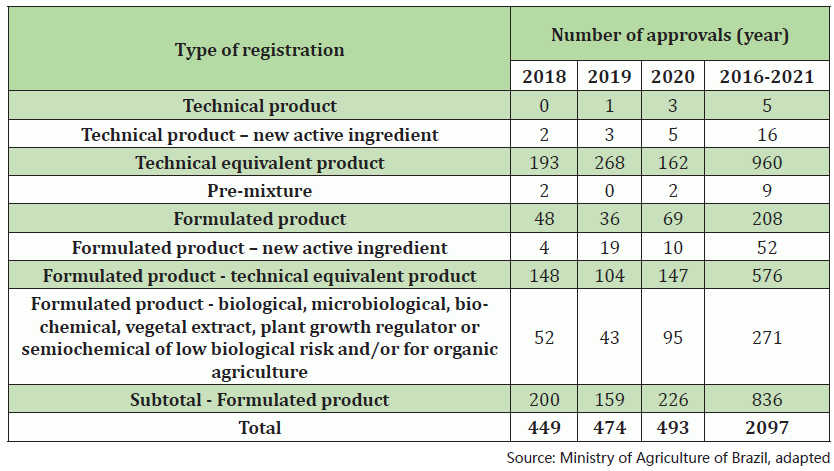

In the year of the pandemic, 2020 was record of approved pesticide registrations. There were 493 registrations; being 309 of those of equivalent products, also known as generics. Nevertheless, the pesticide registration is still the biggest access barrier to the market. The long timeframe for the approval is the main discouragement to potential entrants.

Pesticide registrations involves and are evaluated by federal departments:

- ANVISA – responsible for health related aspects.

- IBAMA – responsible for the environment related aspects.

- Ministry of Agriculture (MAPA) – responsible for the agriculture related aspects and the expedition of the registration certificate.

These departments follow the same guidelines as provided by the legislation, but may also have specific and independent rules from the other involved ministries.

The highlight of the new registrations was the products formulated of “low risk”, which in 2020 the same number of years 2018 and 2019 added were approved, representing 37.7% of the approvals in the category of “formulated products” (chemical products + low risk products).

The increasing number of registrations approved in recent years has attracted the attention of companies in the sector, both those already operating in the market, as well as those that did not yet have Brazil on the business radar. In the first case, because more approved registrations mean more competition, and thus provokes reactions to minimize and prevent the access of new entrants to the market. In the second case, the large number of new registrations gives the misconception that the registration process has become more agile and simplified.

Last year’s record, however, is not necessarily the gateway to the world’s largest pesticide market. Despite the dynamics of the market, the effectiveness of the products, the registration legislation, among other factors, can be, and generally are, very different from the time the process started and when the registration is approved.

Approvals for the registration of a technical product and its respective formulated product can take up to 12 years. This time can make even the approval of the registration unfeasible, because during these years there are many changes to the rules and interpretations of the rules for the purpose of registering pesticides – many of which have a retroactive effect. This, at the very least, further delays the completion of the evaluation, as it inevitably increases the cost of completing and updating the registration dossier.

On the other hand, considering this delay for approval of the registration, in order to access the market more quickly, many companies have resorted to lawsuits against the agencies responsible for the registration of pesticides, based on the legislation that provides for the evaluation of the process in up to 120 days after requesting the registration form.

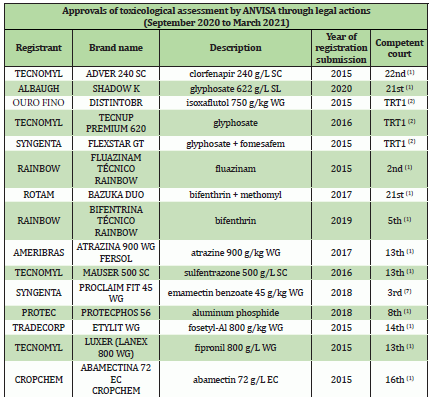

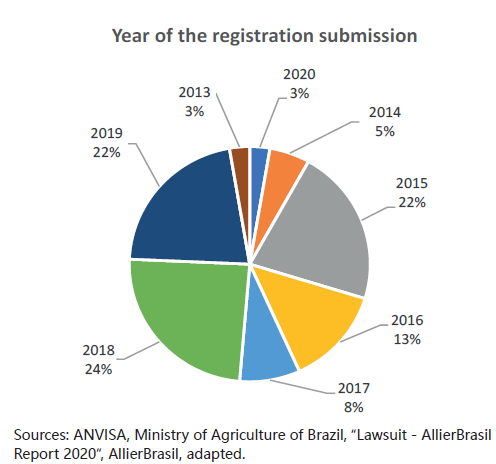

In just 6 months, between September 2020 and March 2021, 38 toxicological assessments’ deferrals were published by ANVISA, resulting from lawsuits filed by companies.

Registration processes filed in 2018 and 2019 represent 46% of the lawsuits. This means the registrations were approved in 3 to 4 years. On the other hand, 26% of the actions refer to registrations filed in 2014 and 2015, that is, 7 to 8 years for approval.

Considering the relatively low costs for this type of lawsuits, and the need to be ahead in the market with more competitive products, companies are increasingly using this kind of resource.

Considering the relatively low costs for this type of lawsuits, and the need to be ahead in the market with more competitive products, companies are increasingly using this kind of resource.

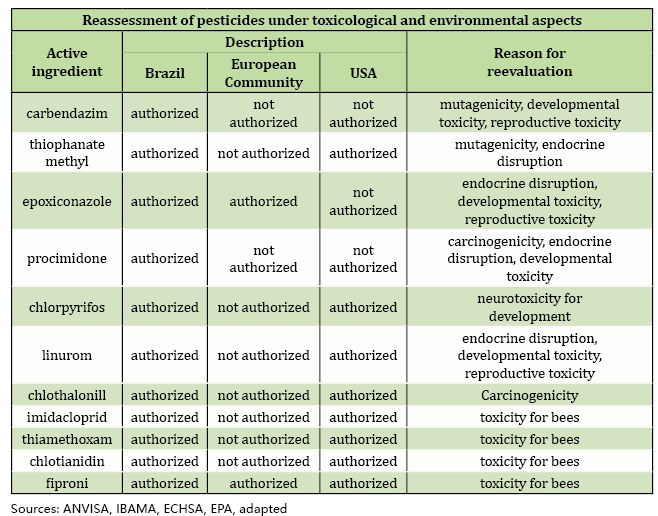

Another current point in the area of pesticide registration is the reevaluations related to the environment and human health. These are necessary, at any time, in order to reassess the safety and use of the products, with IBAMA and ANVISA as main protagonists, which adopt different procedures for the reassessments. In the case of IBAMA, when an active ingredient goes into reevaluation, no product with the same active ingredient should be evaluated, regardless of how long it may take to complete the reevaluation, unlike ANVISA, which does not restrict products with the same active ingredient to be registered. An exception was made in the case of paraquat, whose registration processes for formulated products that were in the queue for evaluation were canceled. In both cases, products already registered can be freely commercialized.

The costs for companies defending the revalued products are high and the total amount is unpredictable. Thus, companies have the practice of grouping through task forces, which in most cases, but not always, the apportionment of expenses is reasonable. A caveat for the environmental reevaluation of the active ingredient thiamethoxam by IBAMA, which the company holding the initial registration, Syngenta, is presenting individually the data for the defense of the molecule.

In addition to the registration of the product at federal level, registration in each state where the product is intended to be marketed is mandatory. There are 26 states, each with specific rules and fees. Any changes to the registry at the federal level must be updated in each state. Any lapse in updating registrations in the states may result in penalties for registrants.

All of these stages of pesticide registration and maintenance are costly – unpredictable in some cases; many of them are too bureaucratic; and are of great complexity. Despite this, the bottleneck is the time for approvals and revaluations of registrations / products, which makes this a major non-tariff barrier, which ultimately restricts access to the market to a reduced number of players.

As an agribusiness consulting company and a pioneer in promoting Brazilian agribusiness abroad, AllierBrasil, in almost 20 years of activity, has enabled the entry of pesticide companies so that they can offer competitive product options to rural producers.