Article by Professor at the Argentine Catholic University.

Ernesto A. ‘Connor has a degree in economics from the University of Buenos Aires (UBA), and a doctorate in economics from the Argentine Catholic University. He was an international consultant to FAO on regional and rural development issues for 7 years, and was also a consultant to the World Bank. He is a former-undersecretary of Regional Economic Planning in Argentina.

He is currently director of the Research Department at the Faculty of Economic Sciences of the Argentine Catholic University, director of the master’s degree in Applied Economics, and Full Professor of Economic Growth and Development at the University. ‘Connor provided the following article for AgriBrasilis.

Argentina’s economic activity has been shocked by the coronavirus crisis, perhaps more than other economies. But Argentina’s economics problems before the pandemic were so profound that short-term challenges, regardless of the long term, are extreme. This article reviews the macroeconomic challenges, the fiscal issue and public debt, the impact of the covid on economic activity, and the paths to recovery, within which agroindustrial chains have a central role.

Macroeconomic challenges and expectations The starting point in 2020 was not the best one: long years of economic stagflation, part of the public debt in default, one of the highest rate inflations of the world, and

uncertain expectations around the new ruling coalition, the Front of All. The economic cycle was accumulating a stagflation process since 2012, as Gross Domestic Product (GDP) in 2019 was similar as 2010 GPD, expressing nearly 10 years of recession. What’s more, inflation will be registering an average of nearly 50% per year, for the period 2018- 2020.

Economic activity is expected to contract by 13% in 2020, the worst one-year decline on record, with inflation above 40 percent, an unemployment rate of 15%, with people below the poverty line estimated in 45%, post-coronavirus effects. Economic and political expectations play an important role. New Administration has increased, in the pandemic context, state intervention, as nearly all countries in the world have done. Nevertheless, some oficial projects have not been neutral for converging expectations. The judicial reform project, the state intervention in soybean oil exporter Vicentin – that has not been solved yet -, the nationalization project of the Parana waterway, the decree that established that internet, pay television and mobile telephony are public services, are some examples.

Monetary policy is dealing with uncertainty: increasing exchange rate controls (cepo cambiario) and capital movements controls, have generated multiple exchange rates, with an exchange gap of 80% between the official and the marginal. Argentina’s debt restructuring offer, towards a solution After months of negotiations, almost all of the main groups of bondholders have supported Argentina’s final debt restructuring proposal, with 99% acceptance.

This engagement with the Argentine government to reach an agreement for the restructuring of Argentina’s outstanding external public debt has allowed it to restructure US$ 68 billion in foreign bonds. After months of wrangling with creditors, the Economy Ministry announced an accord that would push out principal payments after 2026, and give investors about 55 cents on the dollar, depending on the maturity of the notes, an important increase on Argentina’s original offer of last March, of 39 cents. However, the 2020 fiscal deficit would be 12% of GDP.

The Covid impact on economic activity The International Monetary Fund (IMF) warns coronavirus shock will sink the global economy in 2020, predicting a global collapse in GDP of 4.9%. But for 2021, the IMF sees global growth of 5.4 %. The IMF estimates that Brazil’s economy is expected to shrink 9.1 %, and Mexico’s by 10.5 %. For Argentina, the Fund has predicted that the economy will slump 9.9% in 2020. But most private estimates consider a GDP drop of 13% in 2020.

Last June, economic activity in Argentina was down 12.3 % from a year earlier, according to government data published by the INDEC. Argentina’s government has relaxed its lockdown since August, after loosening some quarantine restrictions in June. Nevertheless, Argentina’s economy is forecast to contract 13% this year, on pace for the worst one-year decline on record, along with inflation around 40%, an unemployment rate of 15%, and people below the poverty line of 45%. How can the economy be reactivated?

The two components of domestic demand, investment and consumption, don’t show encouraging perspectives for 2021. The Covid-19 effects on employment, labor informality and incomes are negative por private consumption. Wages have lost purchasing-power against high inflation, leading to consumption not picking up strongly. The biggest losers of the economic drop post Covid-19 are those in the domestic market. Costs of production and funding have been rising, especially for small and medium-sized companies, without considering the large number of bankruptcies in critical sectors such as retail, tourism and gastronomy.

Investment expectations are not converging, as macroeconomics challenges have not still been solved, and the Administration has not shown a comprehensive anti- inflationary economic plan till now. The energy sector is expected to recover, expanding in 2021, mainly linked to the exploitation of hydrocarbons in the Vaca Muerta shale area, and the expansion of mining, in line with better internacional prices. On the other hand, manufacturing industry geared to the domestic market depends on the consumption recovery, as industry exports mainly depend on imports from Brazil, which growth could boost the demand for Argentine exports, mainly wheat, industry and vehicles.

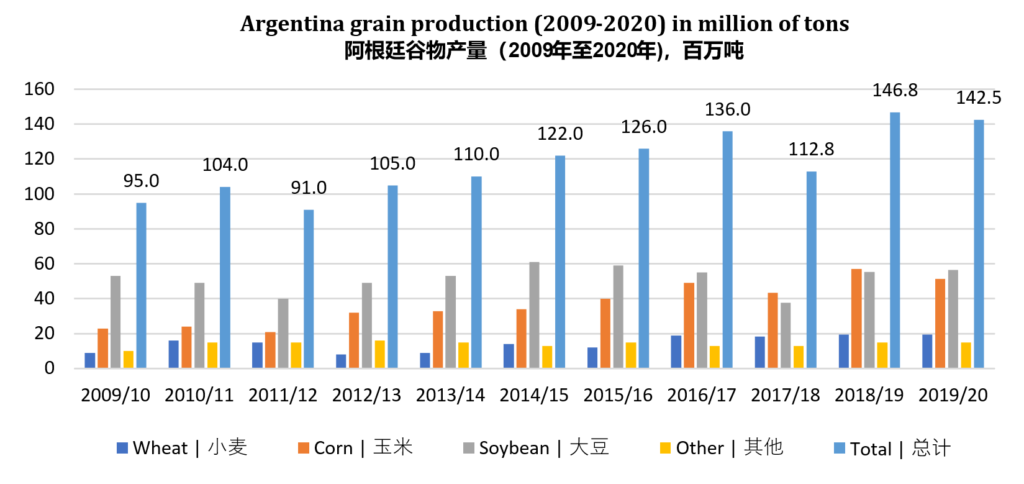

Agricultural and agroindustrial exports relevance in economic recovery Agricultural and food production have not been interrupted by the quarantine restrictions this year. Wheat, corn and soybeans last harvest has nearly been recorded, with a total grain harvest estimated at 142 million tons. Adding all the agro-industrial chains, their exports in 2020 are equivalent to 70% of the country’s total exports, for US$

55.000 millions.

Nevertheless, higher uncertainties, related to tax pressure, the high level of export- taxes rates, market interventions – such as Vicentin affair and the Paraná Gateway nationalization -, import restrictions that may affect fertilizers imports, predict that planting and investment intentions are more uncertain for next months. Last year’s experience is illustrative: total grain production between 2009 and 2014, years of great state intervention, averaged 101 million tons. On the other hand, this production, between 2015 and the present, averaged 132 million tons, with more deregulated policies, as the graph shows.

One more important issue is the drought that is already felt in the region, and the predictions of a "La Niña" phenomenon until the end of the year at least. This will affect the possibility of further planting much more. So, the positive role of the agricultural sector as a leading sector in reactivation may be moderate. Argentina’s economic challenges are relevant. The country’s investment opportunities and recovery capabilities are strong. Public policies have the answer, and the opportunity to break 10 years of stagflation and increased poverty.