“Maintaining an artificially low exchange rate based on foreign debt has a direct negative impact on the beef industry…”

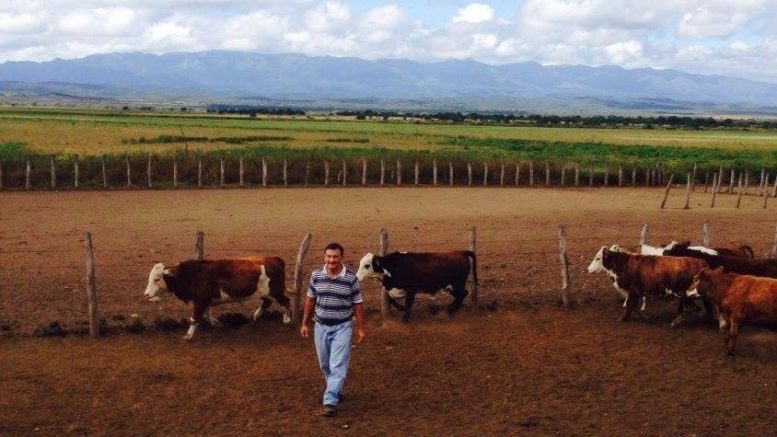

Carlos Federico Kohn is a cattle rancher in northern Argentina, a consultant in the livestock sector, and holds an MBA in agribusiness.

Carlos Federico Kohn, consultant

AgriBrasilis – Is Argentina’s beef sector in crisis?

Carlos Kohn – If we think of the Argentine beef sector as a value chain, it is undoubtedly in crisis. The cattle herd is not only failing to grow but it is actually shrinking. According to data from Senasa, we have 800,000 fewer calves compared to the previous production cycle. If a production chain does not grow harmoniously in all its links, this situation is not sustainable over time.

AgriBrasilis – How are macroeconomic decisions affecting the sector?

Carlos Kohn – Maintaining an artificially low exchange rate based on foreign debt has a direct negative impact on the beef industry, making products less competitive. In a time of high volatility in the global market due to the trade war initiated by Trump, the Argentine sector shows significant weakness compared to its competitors.

AgriBrasilis – How can livestock production resume growth in Argentina?

Carlos Kohn – The great competitive advantage of Argentina’s livestock sector is its diversity, which ranges from the far north, the subtropics, the central humid pampas, to Patagonia. This diversity of climates, soils, and water—almost unique in the world— enables a variety of beef production methods, from traditional extensive pastoral systems to feedlot fattening.

This competitive advantage should be leveraged in high-potential regions like Patagonia by improving efficiency in terms of pregnancy rates, production of kilograms per hectare, and genetic improvement.

The Patagonia region has great productive potential, but increasing output in the sector requires investments in irrigation, genetics suited to cold climates and forage scarcity, as well as planting higher quality forage.

The quality of water available in Patagonia is exceptional for livestock production and is highly valued in international markets. To use it efficiently, investments in water channeling and irrigation are necessary. There are breeds well adapted to the climatic conditions, but introducing them to the region requires high investments in embryos and artificial insemination. The implementation of high-quality, nutritious pastures is feasible, provided there are investments to ensure proper use of water resources.

“The area where Brazilian beef could enter at lower prices is the Patagonia. In this sense, the risk is twofold…”

AgriBrasilis – Why is Argentina buying beef from Brazil?

Carlos Kohn – The decision to import certain cuts of beef from Brazil is another “populist” measure that benefits a supermarket lobby operating mainly in Patagonia. In that region, beef prices are higher than in the rest of the country because production is still limited and involves high costs and risks, especially related to the climate.

As this area is free of foot-and-mouth disease and vaccination, beef from production areas above the 38th parallel cannot enter. If Brazil were to achieve the same sanitary status, beef from there—especially cuts less consumed by Brazilian consumers, like bone-in ribs—could be imported.

AgriBrasilis – Why do you consider this decision a risk?

Carlos Kohn – The area where Brazilian beef could enter at lower prices is the Patagonia. In this sense, the risk is twofold. One risk is that high-value international markets, due to their greater purchasing power, may revoke the region’s status as free of foot-and-mouth disease without vaccination if bone-in beef from another region is introduced, even if it is also free of the disease.

The other risk is the loss of predictability for Patagonia’s livestock farmers; investing in production takes many years before any return on investment is achieved. If the Argentine government takes actions that discourage livestock production, investors may opt for more conservative and lower-value ventures like sheep farming.

AgriBrasilis – What are the consequences for livestock farmers?

Carlos Kohn – If some bone-in cuts from Brazil are imported, the immediate consequence for cattle farmers in Patagonia, in particular, will be the loss of value for the cattle already present in the region. The lack of a strategic perspective that allows productive planning in areas with high climate risk directly impacts investment decisions.

READ MORE: