“We have seen successive drops in export volumes, that should continue in the next quarter, with numbers lower than the averages of previous years”

Haroldo Bonfá is the director at Pharos Consultoria, a specialist in coffee marketing and the international market. Bonfá holds a degree in economics from the University of São Paulo and was the director of international marketing at Companhia Cacique de Café Solúvel.

Haroldo Bonfá, director at Pharos Consultoria

AgriBrasilis – Why are international coffee negotiations slower in 2023? What does this mean for the Brazilian market?

Haroldo Bonfá – Negotiations for the sale of coffee beans and/or soluble coffee follow international quotations: Arabica Coffee stock exchanges, in New York, and Robusta Coffee stock exchanges, in London. It is important to monitor these, in addition to the quotation of international currencies, since the received value will need to be converted into BRL.

It is important to note that the stock exchanges in 2023 are extremely volatile, as well as the dollar, causing greater concern among farmers and traders, and also at the other end (trader – industry) in the sense of seeking the best value for closing prices, both in terms of the dollar and the stock exchange.

At certain times there is an inverted correlation between the exchange rate (USD-BRL) and the New York Stock Exchange. That is, an appreciation of the BRL can affect the increase in prices on the New York Stock Exchange by up to 70%, since the settlement value of the sale in BRL would have to be offset by the increase in New York prices in order to maintain the final value of the sale.

AgriBrasilis – How are coffee stocks and international prices behaving? Why?

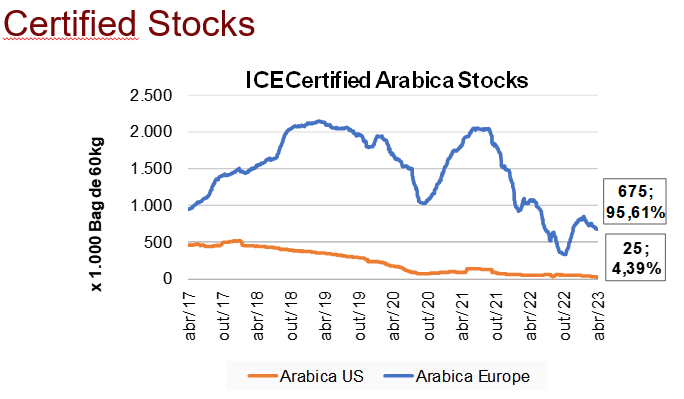

Haroldo Bonfá – International stocks are falling, both for coffee certified by the stock exchanges, and stocks monitored by the American Coffee Association, in addition to those monitored by the European Coffee Federation. Because of the high prices, some companies found it more advantageous to consume their stored product than to buy from the market.

AgriBrasilis – The National Monetary Council approved (04/04/23) price adjustments for arabica (R$ 684.16) and conilon (R$ 460.02) coffee prices for the 2023/24 harvest. Why was this measure adopted and what are the consequences?

Haroldo Bonfá – This practice aims to guarantee the minimum remuneration for the farmer with the authorities (National Supply Company – Conab and the Banks), but it is a little used tool, since the prices practiced in the market are far above the minimum offered by the Government.

Even so, minimum prices can signal the commitment of the Federal Government to acquire or subsidize agricultural products, in case their market prices are below the established minimum prices.

AgriBrasilis – Are there still uncertainties about the Brazilian offer? What are the determinants of supply for the next harvests?

Haroldo Bonfá – The 2023/24 crop has already started to be harvested and will be ready for shipment in two or three months. The question is whether we will have available labor to harvest a high production. In addition, there are concerns about the rains, that can greatly impair the quality of the coffee harvested.

For the 2024/25 season, we will have a very important climatic period. There is always the possibility of frost in winter. Another concern is about the rainfall regime, that affects flowering, setting and maturation of coffee plants.

The coffee harvest takes place only once a year, between March and September. There are discrepancies in the assessments of the crop, that occur for many reasons: territorial extension, considering that in Brazil there are 2.24 million hectares of coffee, being 1.84 million hectares for crops in production and 402 thousand hectares of area in formation (areas that are just being established); methodological differences; in addition to the lack of high-tech equipment.

Regarding the 2022/23 production, there are many uncertainties. The first question is: what will be the volume of coffee exports in the next three months, before the entry of the new harvest? We have seen successive drops in export volumes, that should continue in the next quarter, with numbers lower than the averages of previous years.

There are several reasons for this process, from the variation in prices, that discourages sales/shipments, in addition to external factors, such as the increase in freight rates and the limited supply of containers internationally. Another factor is the perspective of a decrease in international consumption because of a possible recession, mainly in Europe and the USA.

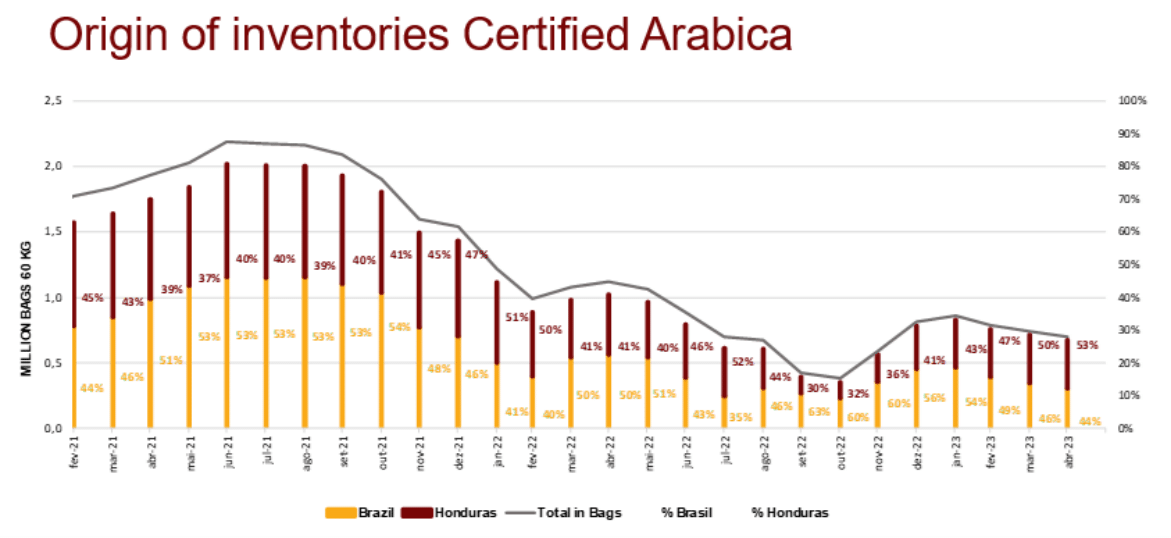

AgriBrasilis – Honduras is once again the main supplier of the Intercontinental Exchange. What does ICE represent and what is Brazil’s participation? What is needed for Brazil to return to the top spot?

Haroldo Bonfá – Honduran coffee went through a period of scarcity, making Brazilian coffee more competitive. Recently, Honduras recovered its production (approximately 5.5 million bags/year), causing Brazilian coffee to lose competitiveness.

READ MORE: